AFO 435 – Borrower collection agency

435.1 Introduction

Library borrower accounts that go unpaid are frequently being referred to professional Bill collectors. To maintain accurate records when collecting on borrower accounts, the Collection Agency needs to be updated with any ongoing changes to a borrower’s account, once that borrower has been sent to collection.

In order for this process to be possible, it is necessary to generate account information of these collectable accounts from the libraries automation system and submit it electronically to the Collection Agency with sufficient information to properly identify the borrower and his/her existing account information. Electronic submission methods in use include FTP and email.

Within the context of this document, a borrower that is ‘in collection’ has been reported to the collection agency and still has outstanding amounts owing on his/her account.

Choosing AFO 435 presents you with two menu choices:

· Mark borrowers for collection

·

Submit files to collection agency

These options are decribed in the next paragraphs.

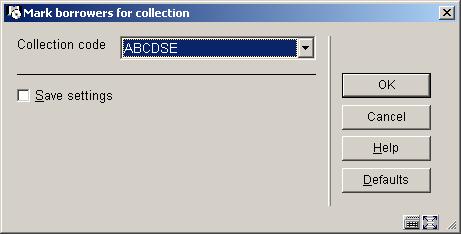

435.2 Mark borrowers for collection

Choosing this menu option presents you with a form containing one field:

Collection code: choose one collection agency code from the dropdown list of collection agency codes for your Circulation metainstitution.

Pressing presents you with the standard procedure for executing processes (online, batch or memory).

The process ignores any charges or invoices made to the borrower’s record on the date it is run. For this reason, this process should be scheduled to run after midnight (when the library is closed) or be run just after the library opens for the day.

Specific borrower types and specific fee types can be ignored by this process by including the specific types in the exemptions lists in the Collection agency code record (in AFO 482).

If a borrower is not yet ‘in collection’, the system sums up the amount of money owed by the borrower that was assessed within the ageing limits defined in the Collection agency code record. The ageing limits are defined as the period between the Aging parameter (in days from today) and Grace period (in days from today). Amounts assessed to the borrower’s account outside this period are ignored. If the summed amount of owed money is greater than the Monetary threshold, the borrower is marked as ‘in collection’. A Collection fee (the amount is defined in the Collection agency code – AFO 482) is added to the borrower’s record.

For a borrower that is already ‘in collection’, the system calculates new amounts owing by the borrower since the last time the borrower was reported to the collection agency.

Once a borrower has been sent to collection, all amounts owing (except for amounts calculated against exempt fee types) are expected to be collected regardless of when the amount was assessed.

Note

A borrower remains ‘in collection’ until the total amount owing (not including amounts calculated against exempt fee types) has reached zero. For a borrower previously ‘in collection’ that has reached a balance of zero, the system reports the zero balance to the collection agency. This should be a clue to the collection agency that this borrower should no longer be considered for collection.

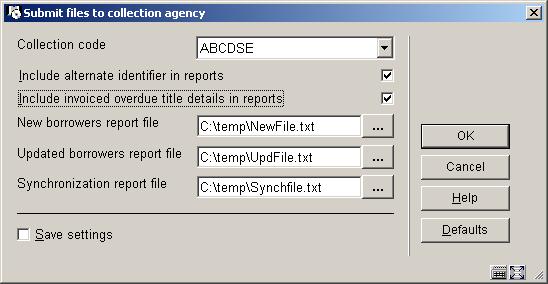

435.3 Submit files to collection agency

This process produces report files whose formats are described in section 435.3.1.

After successfully creating the report files, you can either send the files to the collection agency via FTP or as attachments in an email.

Choosing this menu option presents you with the following form:

Fields on the screen

Collection code: choose the code of the collection agency to which you want o send the file from the dropdown list.

Include alternate identifier in reports: if this option is checked the Borrower alternate identifier/Social Security Number will be included in the report.

Include invoiced overdue details in reports: if this option is checked the report will include details of invoiced overdue items.

New borrowers report file: specify path and file name.

Updated borrowers report file: specify path and file name.

Synchronization report file: specify path and file name.

435.3.1 Output file layout

The formats of the report files are as follows: each field is delimited by “|”. Records are delimited by Carriage return.

· New borrowers report file

For each ‘in collection’ borrower that has not already been reported to the collection agency, one header record is produced, consisting of:

- “H” – record type - header

- Borrower Name Borrower ID/Barcode/RecordNumber

- Borrower Address

- Borrower City

- Borrower State

- Borrower Postal Code

- Borrower Home Phone Number

- Borrower Date of Birth (format DD/MM/YYYY)

- Borrower Category

- Borrower alternate identifier/Social Security Number (if on file and if Include alternate identifier in reports flag set)

- Total (Borrower's Amount Due)

- Earliest debit date of accrued invoices ( the date stamp of the oldest charge on the borrower record)

- Earliest due date of invoiced items (the date stamp of the earliest overdue item that has been invoiced) (format DD/MM/YYYY)

If you have chosen to include details of invoiced overdue items in the report files, the system produces one report record for each item, consisting of:

- “D” – record type - detail

- Borrower Name

- Borrower ID/Barcode/RecordNumber

- Item barcode

- Title

- Author

- Material category

- Item price

- Due date(format DD/MM/YYYY)

· Updated borrowers report file

For each ‘in collection’ borrower that has already been reported to the collection agency, one header record is produced, consisting of:

- “H” – record type - header

- Borrower Name

- Borrower ID/Barcode/RecordNumber

- Borrower alternate identifier/Social Security Number (if on file and if Include alternate identifier in reports flag set)

- Total (Borrower's Amount Due)

- Amount paid (the sum of payments made on the borrower’s record since the last report was sent) )

- New Money Owed (sum of new charges on the borrower’s record since the last report was sent )

- Amount Waived (sum of payments waived on the borrower’s record since the last report was sent)

- Earliest due date of invoiced items (the date stamp of the earliest overdue item that has been invoiced) (format DD/MM/YYYY)

If you have chosen to include details of invoiced overdue items in the report files, the system produces one report record for each item, consisting of:

- “D” – record type - detail

- Borrower Name

- Borrower ID/Barcode/RecordNumber

- Item barcode

- Title

- Author

- Material category

- Item price

- Due date(format DD/MM/YYYY)

· Synchronisation report file

For each ‘in collection’ borrower, one report record is produced in the following format:

- “H” – record type - header

- Borrower Name

- Borrower ID/Barcode/RecordNumber

- Borrower alternate identifier/Social Security Number (if on file and if Include alternate identifier in reports flag set)

- Total (Borrower's Amount Due)

- Earliest due date of invoiced items (the date stamp of the earliest overdue item that has been invoiced)

If you have chosen to include details of invoiced overdue items in the report files, the system produces one report record for each item, consisting of:

- “D” – record type - detail

- Borrower Name

- Borrower ID/Barcode/RecordNumber

- Item barcode

- Title

- Author

- Material category

- Item price

- Due date(format DD/MM/YYYY)